note: you can use the arrow key to click through the image gallery (there are two images).

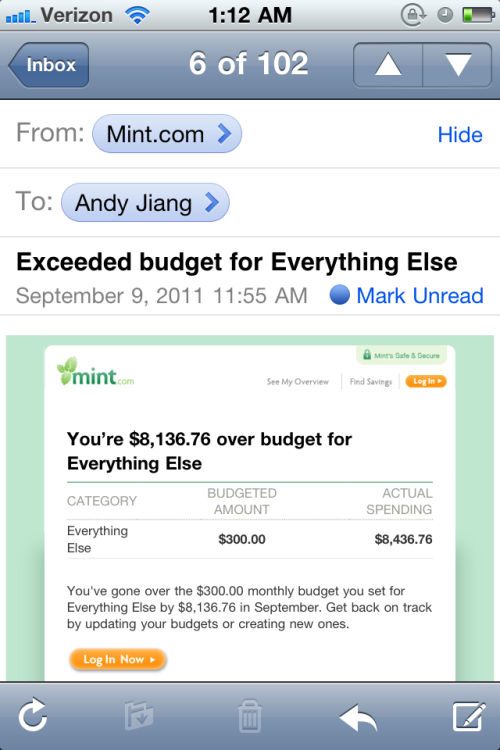

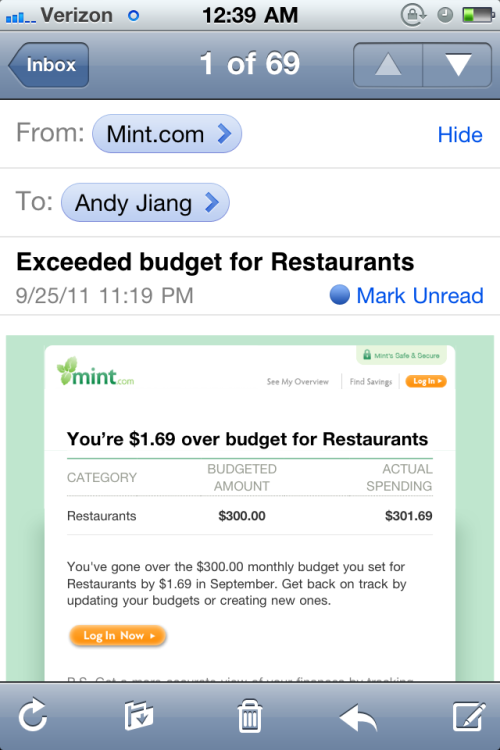

disclaimer: the last time i used mint to allocate my budget was two years ago in 2008. the budgeting that i set at that time in my life is wildly unreflective of my spending habits in the past year. additionally, the horrifying “budget exception” includes several transportation bills (airfare, cabs) that was reimbursed so graciously by my previous employer. the images are just to comically emphasize the drastic change in spending habits from within a few weeks.

of the few extreme aspects of my recent “life changes”–from working at a bank (quite possibly the most corporate, hierarchical environment, to which someone can be subjected) to working at a startup (quite possibly the most formless, unstructured entity), from living in new york city (one of the few cities in the world where you can eat, drink, find drugs, find sex–essentially, satiate any hedonistic appetite–at any given time of the day, borderline unhealthy focus on career development) to living in california (eternal absence of humidity, perpetual laidback attitude and approach to life supported by limitless blue skies and palm trees)–one of the more prominent is spending habits. by pursuing a startup, i forgo the bimonthly paycheck that financed my irresponsible drinking habits and set current spending limitations until our venture reaches cash flow positive (cash flow from operations less maintenance capital expenditures).

spending has significantly declined since my move to california (except for my recent expense on a new macbook air). unfortunately these cut backs occurred at the worst time possible, when i just recently discovered this site www.thisiswhyimbroke.com. where else can you buy an AK-47 lamp? actually, probably the AK-47 lamp store or via this link: http://lmgtfy.com/?q=ak-47+lamp

anyway, here is to my transition from a comfortable life of feeling like a boss and saying “yeah, i can afford it; you go ahead and supersize that” to living like a college student, once again (during which, i became an armchair coinnessur of korean instant ramen, as well as raised my cholesteral levels and tolerance to spicy MSG-filled broth). goodbye $14 stirred dirty gin martinis, laphroiag 10-year with two ice cubes, speakeasies, bottle service (exclusively in lower east side, i should add; meat packing district was out of my first-year financial analyst price range and douche-tolerance zone for me to rage comfortably), tapas bars, bloody marys with brunch, and taking cabs. hello low rent, free google food (thank you fourth roommate, Michael Wei), kalimotxo (equal parts two buck chuck wine and off-brand cola), and costco wholesale food.

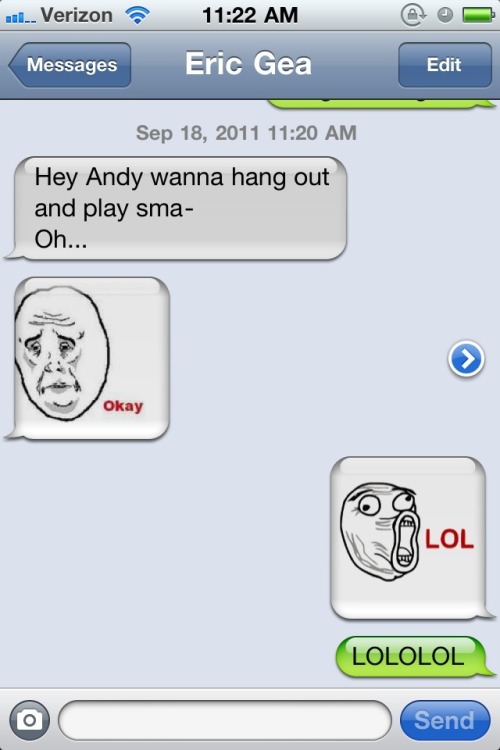

andy

current morale level:

excited. counting down the days until michael gao’s birthday (9/30) and then until we move to Santa Clara (10/7).